Refinance Your Mortgage and Unlock New Opportunities

Lower Your Rate, Reduce Your Payment, or Access Cash: Refinancing Made Easy

Your home is more than just a place to live—it’s a powerful financial asset. Refinancing your mortgage can help you take advantage of lower interest rates, reduce your monthly payments, shorten your loan term, or even tap into your home’s equity to achieve your financial goals. Whether you’re looking to save money, pay off debt, or fund a major expense, our mortgage experts are here to guide you through the refinancing process.

Why Refinance Your Mortgage?

Refinancing allows you to replace your existing mortgage with a new loan that better suits your needs. Here are some of the top reasons homeowners choose to refinance:

1. Lower Your Interest Rate

If mortgage rates have dropped since you first secured your loan, refinancing can help you lock in a lower rate, reducing your monthly payments and saving you thousands over the life of the loan.

2. Reduce Your Monthly Payment

By refinancing into a lower interest rate or extending your loan term, you can decrease your monthly mortgage payment, freeing up funds for other expenses or savings.

3. Pay Off Your Mortgage Faster

Switching from a 30-year mortgage to a 15-year mortgage can help you build equity faster and save on interest, allowing you to own your home outright sooner.

4. Access Cash with a Cash-Out Refinance

Need funds for home improvements, debt consolidation, or other major expenses? A cash-out refinance allows you to borrow against your home’s equity while potentially securing a better loan rate.

5. Convert an Adjustable-Rate Mortgage (ARM) to a Fixed Rate

If you currently have an ARM and want stability in your payments, refinancing to a fixed-rate mortgage can give you long-term peace of mind.

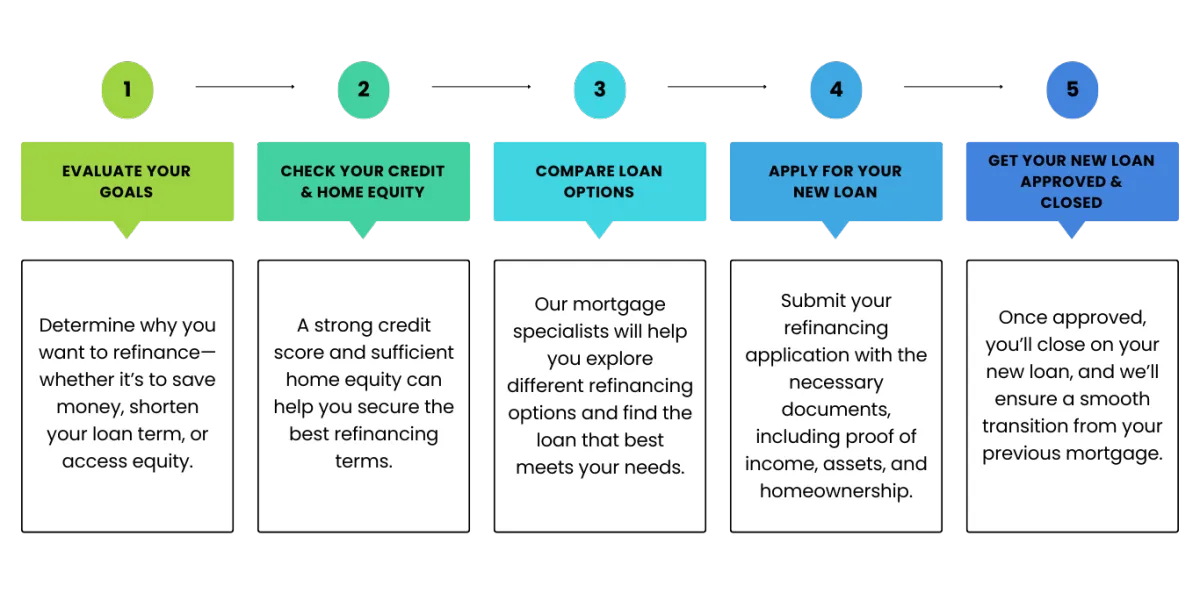

The Refinance Process – What to Expect

Refinancing your mortgage doesn’t have to be complicated. Our team simplifies the process so you can refinance with confidence:Image

Is Now the Right Time to Refinance?

Refinancing can be a smart financial move, but timing is key. You may want to consider refinancing if:

✔️ Interest rates are lower than when you first got your mortgage.

✔️ You plan to stay in your home long enough to recoup closing costs.

✔️ You want to eliminate private mortgage insurance (PMI) by reaching 20% equity.

✔️ You need funds for renovations, debt consolidation, or other financial goals.

Subsection F of 10VAC5-160-60 states "If an advertisement states or implies that a consumer can reduce his monthly payment by refinancing his current mortgage loan, a mortgage lender or mortgage broker shall clearly and conspicuously disclose to the consumer that by refinancing the consumer's existing loan, the consumer's total finance charges may be higher over the life of the loan."

The licensee's advertisement at www.homeloansinc.com/loan-options/refinance/ states that a benefit of refinancing is to lower one's monthly payment but does not disclose that by refinancing, one's total finance charges may increase over the life of the loan.

What Our Clients Say

Click on the keywords below to view reviews from our customers. The reviews will appear below after you click on a keyword.

Highly recommend

Excellent service

Very professional

Knowledgeable team

Smooth process

Customer Reviews:

417 reviews and counting

Let’s Get Started!

Our team is here to help you explore your refinancing options and find the best solution for your needs. Contact us today for a free consultation and see how refinancing your mortgage can work in your favor!

COMPANY

NMLS: 1281448 | COMPANY NMLS: 1728740

CUSTOMER CARE

LEGAL

© Copyright 2025. Jason Sharon, Broker/Owner of Home Loans Inc. All Rights Reserved.