Cash-Out Refinance – Tap Into Your Home’s Equity

Turn Your Home’s Equity Into Cash for Life’s Biggest Expenses

Your home is one of your most valuable financial assets, and with a cash-out refinance, you can leverage its equity to access funds for major expenses. Whether you’re looking to renovate your home, consolidate debt, cover education costs, or handle unexpected expenses, a cash-out refinance can be a smart financial move that offers lower interest rates than personal loans or credit cards.

What Is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new loan that is larger than what you currently owe. The difference between the new loan amount and your remaining mortgage balance is given to you as cash, which you can use however you see fit. This type of refinancing allows you to take advantage of your home’s increased value while potentially securing a better interest rate.

Benefits of a Cash-Out Refinance

1. Access a Lump Sum of Cash

Get the funds you need in one lump sum to finance large expenses, home improvements, or other financial goals.

2. Lower Interest Rates Compared to Other Loans

Mortgage rates are typically lower than rates on credit cards, personal loans, or home equity loans, making a cash-out refinance a cost-effective borrowing option.

3. Debt Consolidation

Use the cash to pay off high-interest debt, such as credit cards or personal loans, and streamline your payments into one manageable monthly mortgage payment.

4. Increase Your Home’s Value with Renovations

Invest in your home by using the cash to renovate or upgrade your property, potentially increasing its resale value and overall appeal.

5. Potential Tax Benefits

Mortgage interest may be tax-deductible when used for home improvements (consult a tax advisor to understand your eligibility).

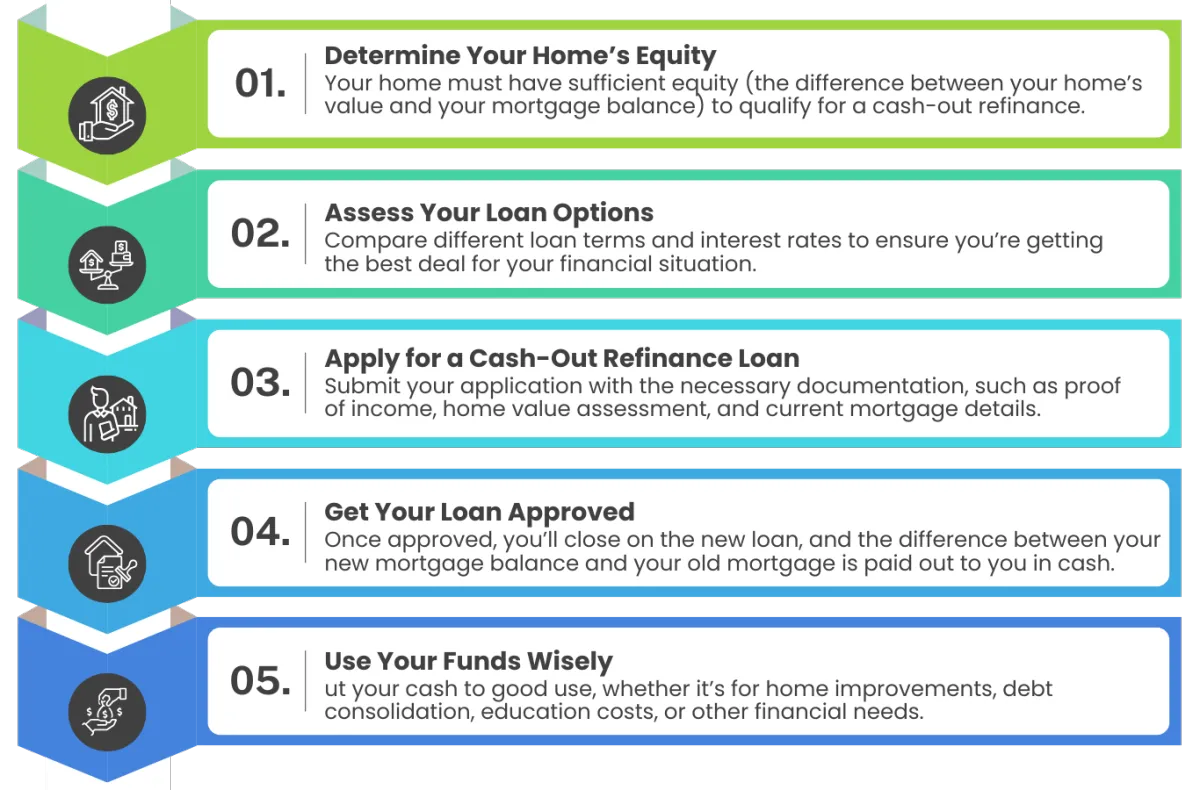

How Does the Cash-Out Refinance Process Work?

Refinancing your mortgage to access cash is a straightforward process. Here’s what to expect:

Is a Cash-Out Refinance Right for You?

A cash-out refinance can be a great financial tool, but it’s important to ensure it aligns with your long-term goals. Consider refinancing if:

✔️ You have built significant equity in your home.

✔️ You need funds for a major financial goal or expense.

✔️ You can secure a lower interest rate than other borrowing options.

✔️ You’re comfortable with the new mortgage payment and terms.

See Our Reviews

💬 Real Stories. Real Results.

See how our clients are experiencing success through our expert funnel designs.

Contact UsLet’s Get Started!

Our team is here to guide you through the cash-out refinancing process and help you determine if it’s the right move for your financial future. Contact us today for a free consultation and take the first step toward unlocking your home’s equity!

COMPANY

NMLS: 1281448 | COMPANY NMLS: 1728740

CUSTOMER CARE

LEGAL

© Copyright 2026. Jason Sharon, Broker/Owner of Home Loans Inc. All Rights Reserved.